Blockchain technology’s junction with consumer electronics is changing people’s ownership, commerce, and interaction with their devices. Rising as a revolutionary force in tech ownership is tokenization—the process of expressing real or digital assets as blockchain-based tokens. Tokenized devices—from wearables and IoT devices to cellphones and laptops—promise to democratize access, improve transparency, and open fresh business models. However, this implies different things for customers, manufacturers, and the larger tech ecosystem. Here, we discuss how Blockchain and cryptocurrencies are altering ownership in the digital era.

Rise of Tokenization

Tokenizing a physical device turns its ownership rights into a distinct, transferable digital token on a blockchain. Since these tokens are unchangeable proof of ownership, they let consumers transfer, lease, or collateralize their devices. A tokenized smartphone, for instance, may be sold peer-to-peer without middlemen and with its whole repair record and validity confirmed on-chain. Multiple trends drive this change.

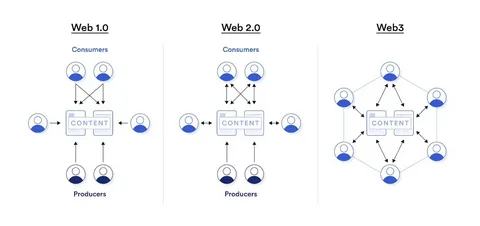

Web3 Integration

Blockchain-based digital IDs for devices allow IT behemoths like Apple and Samsung to interface with metaverse ecosystems and distributed programs (dApps), therefore enabling their experimentation with them.

NFTs for Hardware

Companies such as Acer and HTC have introduced limited-edition NFTs linked to real goods, which offer special access to software updates or VIP services.

Circular Economy Incentives

Startups like ReToken compensate consumers with crypto tokens for returning old devices, motivating device recycling. “MIT blockchain researcher Dr. Linda Parker explains that tokenization closes the distance between digital utility and physical ownership. It turns devices from fixed objects into dynamic assets with earning or appreciation value.

Democratizing Access

A major effect of blockchain is its capacity to democratize technological access. Tokenized lease models and crypto-enabled micropayments are helping high-end devices to be reasonably priced in areas without a strong banking infrastructure. Projects like Helium Mobile let consumers pay crypto for network usage by buying tokenized data plans. Fractional.art and other platforms let organizations split expenses and use rights by collectively owning tokenized gadgets. This approach is quite transforming, especially in impoverished countries.

Startups like Bundle Africa provide tokenized computers that Nigerian consumers can rent to own using stablecoin payments, therefore avoiding conventional credit checks. “Blockchain removes gatekeepers, notes Bundle CEO Yele Bademosi. Anyone with a crypto wallet can access the tools required to flourish in the digital economy. Still, problems abound. While government uncertainty in nations like India and Brazil stunts uptake, price volatility in crypto markets might hinder long-term lease arrangements.

Enhanced Transparency

The OECD estimates that counterfeit gadgets generate around $1 trillion in yearly losses worldwide. Tokenizing solves this by including unchangeable ownership records in devices. Companies like Chronicled use blockchain-enabled microchips in devices so consumers may scan a QR code and validate authenticity on-chain. Bosch’s blockchain project gives IoT devices a digital passport tracking maintenance, carbon impact, and component sources.

Transparency like this also solves e-waste. Tokenizing devices lets manufacturers encourage recycling. Users of every returned gadget might win tokens good for discounts or cryptocurrency. Fairphone and Dutch firm Closing the Loop have teamed up to tokenize recyclable materials and pay participants for Ethereum-based tokens. Blockchain transforms sustainability into a real value proposition,” notes Fairphone CEO Eva Gouwens. Consumers can earn from good conduct and understand how their decisions affect their surroundings.

Economic Models

Tokenizing is erasing the boundaries separating access from ownership. Users can buy time-bound usage rights expressed by tokens rather than gadgets straight-forward. An “asset-light” strategy is becoming popular in business IT: Companies like IBM utilize tokenized access cards to handle staff laptops, automatically deleting rights when employees leave. Microsoft’s Xbox has tested NFT-based subscriptions, letting players tokenize console access and sell it on secondary markets.

This opens liquidity for customers. A tokenized drone leased to a photography studio during off-peak may provide passive income for the owner. Startups like 4th Wave allow such peer-to-peer smart contract rentals, using stablecoins to handle payments. Still, detractors caution against over-complicating things. “Not every gadget needs a token,” tech commentator Marques Brownlee contends. Blockchain adds needless friction for common objects like toasters.

Regulatory and Security Hurdles

Most nations lack explicit rules for tokenized physical objects. The U.S. SEC’s continuous litigation against the NFT platform Impact Theory draws attention to the dangers of mixing securities with utility tokens. Issues of privacy Public blockchains’ storage of device use data could reveal private information. One might find a solution in hybrid chains—public for ownership, private for data.

Cybersecurity Vulnerabilities Hackers are increasingly targeting IoT devices. According to Kaspersky’s 2024 research, 43% of tokenized devices had weaknesses in their smart contracts. Manufacturers are responding with hybrid strategies. Zero-knowledge proofs, for instance, allow Sony’s blockchain business to verify device ownership without divulging user information.

Conclusion

Tokenized devices provide unprecedented flexibility, openness, and financial possibilities, changing the tech ownership paradigm. Blockchain lets users own and benefit from their devices by linking the physical and digital worlds. Still, broad acceptance depends on conquering cultural, technical, and legal obstacles. One thing is apparent as the distinctions between hardware and software blur: the future of tech ownership is about what you can do with the token in your wallet, not only about holding a gadget.