With its goal to facilitate low-cost, quick cross-border payments, Stellar Lumens (XLM) has long been a major participant in the changing Cryptocurrency Market scene. Many investors and blockchain aficionados are wondering: What is the future of XLM, and how high can the Stellar price rise as we forward to the years 2025 via 2030? This in-depth study investigates long-term Stellar price forecasts, the main forces behind its possible expansion, and what to expect from XLM in the fast shifting terrain of distributed finance (DeFi) and worldwide payments.

Stellar Lumens and Their Importance for Bitcoin

Understanding the intent and technology underlying this digital asset can help one appreciate Stellar Lumens price projections. Supported by the Stellar Development Foundation (SDF), co-founder of Ripple Jed McCaleb founded Stellar in 2014 as a blockchain-based payment network meant to link banks, payment systems, and people with almost instantaneous transaction finality.

Native token of the Stellar network, XLM helps to avoid blockchain spam and ease transactions. Stellar has maintained its place in the real-world financial ecosystem by means of strategic alliances with big organizations like IBM, MoneyGram, and Circle over years.

XLM Price Context and History

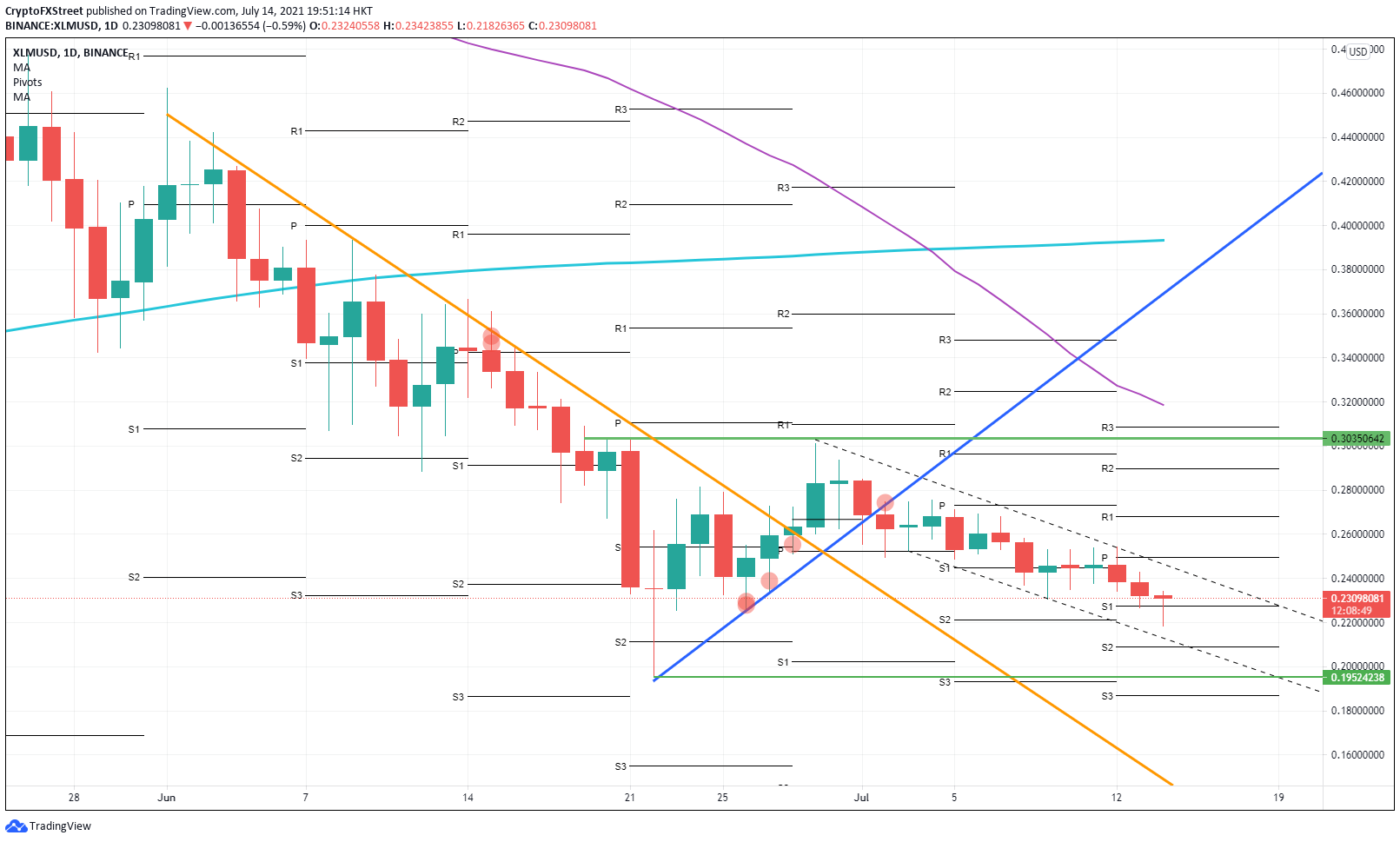

Examining XLM’s past performance and market cycles helps us to grasp its price estimates through 2030. During the first significant altcoin frenzy in early 2018, XLM peaked at about $0.94, all-time high. Like many cryptocurrencies, it dropped drastically during the bear market, though, and struggled to recover those highs in the next years.

Rising interest in altcoins during the 2020–2021 bull run helped XLM top $0.70 in May 2021. Still, macroeconomic headwinds in 2022 and 2023, market volatility, and regulatory uncertainty drove fresh price corrections.

With a vibrant community and rising institutional interest, XLM stays a top 50 cryptocurrency by market capitalization as of mid-2025. Its technical strengths—low fees, smart contract capabilities via Soroban, and interaction with significant fintech solutions—help to explain its long-term optimistic view.

Stellar Lumens Price Forecast 2025

Rising acceptance of blockchain-powered remittance solutions can help Stellar Lumens going forward into 2025. By the end of 2025 XLM might see a price range between $0.45 and $1.10 if present development goals are reached—such as the broad deployment of Soroban smart contracts and tighter integration with MoneyGram’s crypto-to- cash services.

Also very important might be institutional alliances and central bank digital currency (CBDC) cooperation. Increased use of Stellar as a basic layer for CBDCs—most famously the Ukraine CBDC pilot—could stimulate demand for XLM as numerous central banks investigate it.

Macroeconomic conditions, global crypto assets, and competition from ripple (XRP), Algorand, and other cross-border settlement systems will be key industry drivers in 2025.

XLM Price Forecast for 2026

Blockchain technology should be much more ingrained in financial infrastructure by 2026, especially in developing nations. Stellar stands out over more speculative initiatives because of its unique position as a compliant, scalable solution for cross-border micropayments.

Should Stellar be able to include more stablecoin protocols—USDC and regional fiat-backed tokens—into its network and raise developer adoption of Soroban, XLM might have significant transactional value. Under this scenario, experts project XLM trading between $0.85 and $1.50 based on moderate global crypto acceptance and steady network expansion.

Should a fresh bull market develop driven by better global regulatory systems and retail investor comeback, XLM might test its all-time highs and maybe reach the $2 level.

2027 Stellar Lumens Price Forecast

Driven by extensive use in remittances, distributed identity (DID) systems, and financial inclusion platforms, the utility of the Stellar network may easily exceed conjecture by 2027. Because of their huge remittance flows and underbanked populations, Africa, Southeast Asia, and Latin America remain bright areas for Stellar-based solutions.

XLM might also experience even more powerful upward trajectory if Stellar manages to establish itself as an interoperable layer with other blockchains using bridges and cross-chain liquidity protocols.

Depending on technology uptake, world economic events, and competitiveness, a reasonable pricing projection for 2027 runs from $1.20 to $2.50. Under more optimistic conditions, driven by DeFi integration and general public acceptance, XLM might aim near $3.

XLM Long-Term Project: 2028– 2030

Looking ahead, mainstream adoption and development of cryptocurrencies will depend critically on the years 2028 through 2030. Blockchain technology is expected by analysts to enter daily financial operations for both people and businesses. Only projects with actual value and compliance ready can flourish in this stage.

Long-term competitor in the cross-border financial scene Stellar is focused on interoperability, regulatory alignment, and low-cost infrastructure. XLM might hit new all-time highs before the end of the decade if global payment channels progressively turn to Stellar for liquidity and remittance handling.

With ultra-bullish models estimating prices as high as $7 to $10, assuming exponential user growth and ecosystem expansion, some estimates indicate XLM might trade in the range of $2.50 to $5.00 by 2030.

Still, these forecasts rely on macro factors such tokenization of assets, financial decentralization, and the regulatory environment—especially in the United States, Europe, and Asia.

Risks and Difficulties for Stellar Lumens

Though the future seems bright, XLM carries some hazards. The main difficulties consist in fierce rivalry from both crypto-native platforms such as Ripple, Algorand, and Hedera Hashgraph as well as conventional banking systems implementing their own blockchain technologies.

Regulatory uncertainty is another element, particularly while governments consider the consequences of distributed finance. Although Stellar is sometimes considered as more regulation-friendly, any negative policy developments regarding crypto remittances or stablecoin issuing could affect its development path.

Price rise may also be hampered by network stagnation or failure to draw developer interest for Soroban smart contracts. Investors should follow Stellar Development Foundation development updates as well as GitHub ecosystem activity including partner integrations.

XLM buying and storage location

XLM is easily accessible on main bitcoin exchanges including Binance, Coinbase, Kraken, and Uphold for individuals eager in making Stellar Lumens investments. Hardware wallets like Ledger and Trezor enable XLM storage; software wallets designed for the Stellar ecosystem like Lobstr and Solar Wallet also support XLM storing. When handling digital assets, users should always give safe storage, two-factor authentication first priority as well as reliable platforms second thought.