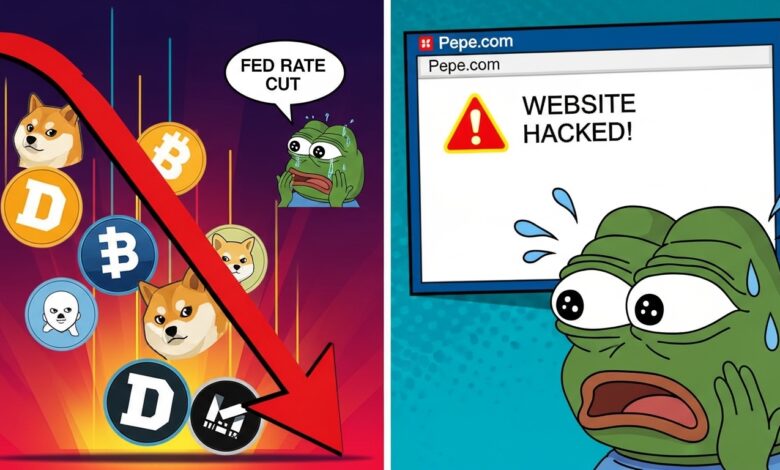

Meme Coins Fall After Fed Rate Cut & Pepe Website Hacked

Meme coins fall after Fed rate cut as crypto markets reel. The Pepe website was also hacked. Get the full meme coin news breakdown here.

Meme coins fall after Fed rate cut announcements sent shockwaves through digital asset markets, and just as traders were processing the macro-level turbulence, another gut punch arrived: the official Pepe coin website was hacked. Together, these two events have created a storm of uncertainty around the meme coin sector, leaving investors scrambling to reassess their positions and risk tolerance in what has become one of the most volatile corners of the cryptocurrency market.

It was a week that perfectly illustrated why meme coins remain as thrilling as they are dangerous. While Bitcoin and Ethereum absorbed the Federal Reserve’s latest policy decision with relative resilience, meme coins — assets whose value is more sentiment-driven than fundamentals-based — bore the brunt of the sell-off. Understanding why meme coins reacted so sharply to the Fed’s move, and what the Pepe website breach means for the broader ecosystem, is essential for anyone navigating this high-stakes corner of crypto in 2025.

Meme Coins Fall After Fed Rate Cut: What Actually Happened

When the Federal Reserve announced its latest rate cut decision, markets reacted in ways that caught many retail crypto investors off guard. Conventional economic wisdom suggests that rate cuts are bullish for risk assets — cheaper borrowing costs tend to push investors toward higher-yielding, riskier investments, which historically includes cryptocurrencies. However, the Fed’s tone this time was anything but celebratory. Policymakers paired the rate cut with hawkish language about inflation persistence and signaled that future cuts would be far more measured than previously expected.

That nuance — a rate cut wrapped in a cautious, almost restrictive tone — was enough to spook markets broadly. Equities dipped, and the crypto market followed. But while Bitcoin and Ethereum managed to recover relatively quickly, meme coins collapsed hard. Tokens like Dogecoin (DOGE), Shiba Inu (SHIB), PEPE, FLOKI, and dozens of smaller meme-based altcoins saw double-digit percentage drops within hours of the Fed’s announcement.

The reason meme coins are disproportionately affected in these situations comes down to the nature of their value proposition. Unlike Bitcoin, which some investors treat as digital gold and a macro hedge, meme coins have no underlying utility or revenue model. Their prices are powered almost entirely by community momentum, social media hype, and speculative appetite. When macro conditions tighten — even slightly — the speculative froth is the first thing to evaporate.

Why the Fed’s Hawkish Tone Matters More Than the Rate Cut Itself

Traders and analysts have started paying much closer attention to the language accompanying Fed decisions, often more so than the numerical rate changes themselves. In this case, Fed Chair Jerome Powell emphasized that the central bank remained “data-dependent” and was not committing to a clear easing path. For meme coin investors, who often rely on broad risk-on sentiment to fuel rallies, that kind of ambiguity is toxic.

When liquidity conditions look uncertain, the market hierarchy becomes brutally apparent. Institutional and semi-institutional players move funds from speculative small caps — which includes essentially all meme tokens — toward perceived safe havens within crypto. That capital rotation hammers meme coins with selling pressure while doing relatively little damage to the top-tier assets.

Historical Patterns: Meme Coins and Fed Policy Decisions

This is not the first time we’ve seen meme coin prices crash in response to Federal Reserve decisions. Looking back at 2022, the aggressive rate hike cycle that year was a death sentence for the meme coin supercycle that had taken hold in late 2021. Coins like Shiba Inu lost over 90% of their value during that period. While the current environment is different — rate cuts rather than hikes — the hawkish undertone has reminded many in the market of that painful era.

What makes this moment particularly notable is that meme coins had been enjoying a significant resurgence heading into this Fed announcement. The broader altcoin season was gaining traction, meme coin trading volumes had spiked across major exchanges, and retail investor participation was climbing again. The abrupt reversal after the Fed’s statement has raised uncomfortable questions about the sustainability of that momentum.

Pepe Website Hacked: A Security Crisis Hits the Meme Coin Community

Just as the meme coin market decline was dominating crypto news cycles, a separate but equally alarming story broke: the official website of Pepe coin (PEPE) had been hacked. Cybercriminals gained unauthorized access to the site and reportedly used it to spread malicious links designed to drain connected crypto wallets — a classic and devastating phishing attack targeting unsuspecting PEPE holders.

The Pepe website hack is a serious event that goes beyond just one token’s community. It highlights the systemic security vulnerabilities that continue to plague the meme coin ecosystem, which often lacks the development resources and security infrastructure of more established blockchain projects. Many meme coin projects — even successful ones with billions in market capitalization — run lean operations with minimal full-time developers and security auditing.

How the Pepe Website Hack Unfolded

Reports from the PEPE community first surfaced on social media platforms, with users warning others not to visit the official Pepe website after noticing unusual redirects and suspicious wallet connection prompts. Within hours, blockchain security firms confirmed that the site had been compromised. Hackers had replaced legitimate wallet interaction tools with fraudulent smart contract approvals designed to drain funds from any wallet that connected.

On-chain analysts were able to track wallets associated with the exploit, revealing that a meaningful sum had already been drained from victims before the community could sound the alarm widely enough. The Pepe development team responded by taking the website offline and issuing warnings across their official social media channels, but for some users, the warning came too late.

This type of attack — often called a front-end exploit or DNS hijacking attack — has become increasingly common in the crypto space. Rather than attacking the blockchain itself (which is extraordinarily difficult), hackers target the web infrastructure that projects use to interact with users, which is far more vulnerable by comparison.

What the Hack Means for PEPE Token and Investor Trust

The Pepe coin hack could not have come at a worse time. Already under price pressure from the broader meme coin sell-off following the Fed announcement, the PEPE token saw accelerated selling as news of the security breach spread. Trust is the most fragile and most important currency in the meme coin world, and a high-profile website compromise chips away at it fast.

In the short term, many holders chose to sell rather than wait and see whether the team could adequately address the situation. That selling pressure compounded the losses that PEPE was already experiencing from the macro-driven meme coin decline. The combination of a Federal Reserve-induced market downturn and a security breach created a perfect storm for the token.

Longer term, the hack raises serious questions about whether the Pepe project’s development team has the resources and expertise to adequately secure its infrastructure — a question that will weigh on investor confidence for weeks if not months.

The Broader Meme Coin News Landscape: What Investors Need to Know

Beyond PEPE specifically, this week’s events paint a telling picture of the meme coin market in 2025. The sector has matured in some ways — trading volumes are higher, institutional awareness is greater, and some meme tokens have developed genuine communities and use cases. But the fundamental risk profile has not changed: meme coins remain highly speculative assets that are acutely sensitive to both macroeconomic signals and community sentiment.

Altcoin Market Reaction: Which Meme Coins Were Hit Hardest

Across the board, meme-based tokens saw significant drawdowns following the Fed announcement and the Pepe hack news. Dogecoin (DOGE) fell sharply, revisiting support levels that had held for weeks. Shiba Inu (SHIB) dropped in tandem, with trading volume spiking as panic sellers rushed to exit. FLOKI, which had been one of the better performers in the recent altcoin rally, also saw significant losses.

Smaller, newer meme coins on Solana — a blockchain that had become a hotspot for meme token launches in recent months — experienced even more dramatic losses, with some tokens losing 30–50% of their value in a matter of hours.

The Risk Management Problem in Meme Coin Investing

One of the persistent challenges in meme coin investing is that traditional risk management frameworks simply do not apply in the same way. Stop-losses can be triggered in seconds during volatile swings. Fundamental analysis is largely irrelevant since most meme coins have no underlying business model. And the community dynamics that drive prices can shift with breathtaking speed based on a single tweet, a celebrity endorsement, or as we’ve now seen, a Federal Reserve press conference or security breach.

What Comes Next for Meme Coins After the Fed and Pepe Hack?

Despite the rough week, the meme coin sector is unlikely to disappear. These assets have demonstrated remarkable resilience over multiple market cycles. Dogecoin, often dismissed as a joke, has now been around for over a decade. PEPE, despite the website hack, has a passionate community that is unlikely to abandon the project overnight.

The trajectory from here will depend on several factors. On the macro side, future Federal Reserve communications will be closely watched. Any signal of a more aggressive easing cycle could reignite the risk-on sentiment that meme coins need to thrive. On the project-specific side, how the Pepe team responds to the hack — whether they invest in serious security improvements, compensate affected users, and rebuild trust transparently — will go a long way toward determining PEPE’s recovery timeline.

Could This Be a Buying Opportunity for Meme Coin Traders?

Some contrarian traders are already eyeing the dip as a potential entry point. Historically, sharp sell-offs in meme coins following macro events have sometimes presented short-term trading opportunities for those with high risk tolerance and a quick exit strategy. However, this is emphatically not financial advice, and the added uncertainty from the Pepe website security breach makes the risk calculus far more complex than a standard market dip.

Anyone considering re-entering or adding to meme coin positions right now should be acutely aware that sentiment can deteriorate further before it improves, and that the meme coin space offers no guarantees whatsoever.

Conclusion

This week’s twin shocks — meme coins fall after Fed rate cut and the Pepe website hack — serve as a sharp reminder of the unique and unforgiving nature of meme coin investing. Macro policy shifts that barely dent Bitcoin can devastate meme token portfolios in hours. Security vulnerabilities that more established projects might survive can permanently damage trust in a meme coin community. The margin for error in this space is razor-thin.

Whether you’re a seasoned meme coin trader or a curious newcomer, staying on top of meme coin news is not optional — it’s essential. The assets that make the biggest headlines in this space can reverse direction faster than almost anything else in financial markets. Following credible crypto news sources, monitoring on-chain data, and keeping a clear-eyed view of the risks involved is the foundation of any intelligent approach to this sector.

If this breakdown of the latest meme coin market developments was useful to you, bookmark this page and share it with your crypto community. The meme coin space never sleeps — and neither does the news that moves it.

See more;Are Meme Coins on the Rise Again? Market Signals Decoded