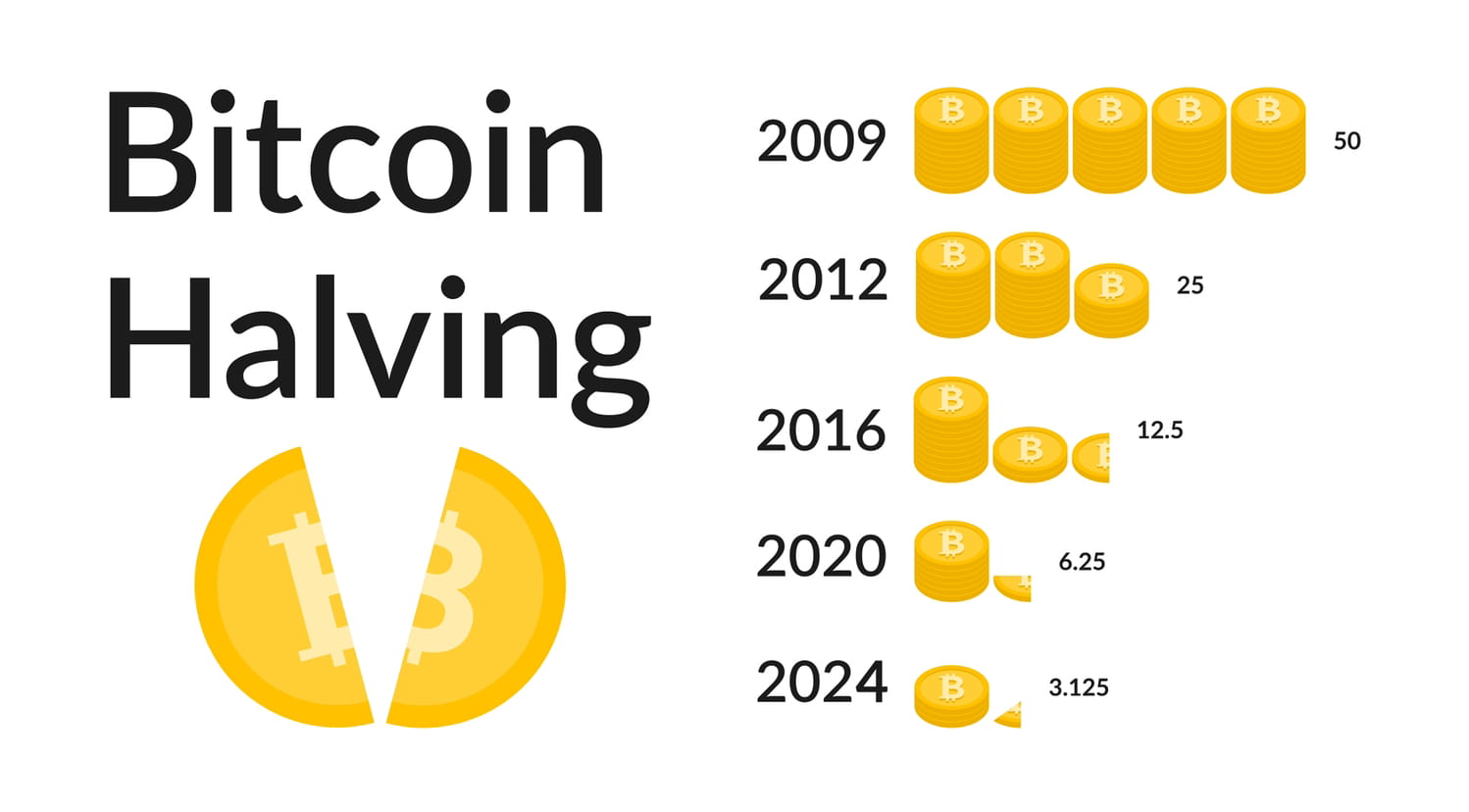

Following the April 2024 Bitcoin halving, the Bitcoin mining environment finds a turning point as we travel through 2025. This event fundamentally changed the financial dynamics for miners all around by lowering the block reward from 6.25 BTC to 3.125 BTC. Rising operational costs, changing mining hardware, fast global hashrate, and pressure to embrace sustainable energy practices have miners negotiating a climate where survival depends critically on efficiency and adaptation.

The fourth halving in Bitcoin’s history hastened the move toward industrial-scale mining and greener infrastructure, not only cut payouts. Offering investors, miners, and crypto enthusiasts a thorough dive into the future of decentralized, energy-intensive digital asset generation, this paper investigates post-halving profitability, network hashrate evolution, and energy consumption trends that define Bitcoin mining in 2025.

Profitability Following the Halving of 2024

The most immediate result of the 2024 halving was a dramatic drop in block miner income. Although post-halved Bitcoin’s price has seen positive growth, hovering about the $80,000 mark as of mid-2025—this alone has not been sufficient to offset the payout drop for many operators. Profitability has dropped for smaller or less efficient miners, which has driven a trend in industry-wide mining consolidation.

This has made areas with affordable, sustainable energy—like Texas, Paraguay, and portions of Scandinavia—strategic sites for competitive mining activities. Additionally changing their price strategies are hosting facilities and cloud mining platforms to keep customer acquisition while preserving profitability.

Moreover, transaction fees—which peaked during the Runes and Ordinals craze—have settled and fewer of them contribute to total miner income. Profitability today so mostly relies on operational availability, real-time energy arbitrage techniques, and efficiency measures. Large-scale operators who can dynamically scale operations, guarantee fixed-rate energy contracts, and apply AI-driven mining optimization algorithms would find this environment ideal.

Evolution of hashrates industrial arms race and network resilience

The Bitcoin network hashrate has kept increasing in 2025, exceeding 700 EH/s, proving the mining industry’s endurance and adaptability even with reward halving. Next-generation ASIC miners, improved cooling systems, and ever more automated mining infrastructure all help to drive this seeming contradictory expansion.

Expanding their fleets with ultra-efficient machines having over 30 J/TH (joules per terahash) energy performance, such as Bitmain’s S21 series and MicroBT’s WhatsMiner M60 series, mining heavyweights including Marathon Digital Holdings, CleanSpark, and Bitdeer have added Particularly in areas of the Global South rich in energy, the use of liquid immersion cooling and hydro-cooled containers has also helped maximize uptime in high-temperature surroundings.

Concurrent with this has become a strategic focus hashrate decentralization. Rising geopolitical tensions and legislative crackdowns in nations like Kazakhstan and Iran have miners aggressively diversifying their sites to reduce geopolitical risk. Modular and movable mining farms—which may be quickly implemented next to renewable energy sources or surplus energy from oil flaring and hydropower plants—have emerged from this diversification.

Energy Trends: toward a greener, cleaner hash

Public and legal debate in 2025 will center still on the environmental effects of Bitcoin mining. Still, great progress has been done to lower the carbon footprint of the sector. Data from the Cambridge Centre for Alternative Finance shows that up from 39% in early 2023, over 58% of the total network energy of Bitcoin now originates from renewable or carbon-neutral sources.

Integrating their activities with wind, solar, geothermal, and hydropower assets, miners have been progressively embracing sustainable energy partnerships. Especially in El Salvador and Bhutan, projects showing how nations with energy surpluses may monetize Bitcoin mining for stranded or underused power.

Further encouraging clean practices, ESG-oriented investors are now actively supporting green miners. Funds include ARK Invest, BlackRock’s Bitcoin ETF division, and Fidelity Digital Assets are including sustainability measures into their due diligence procedures, therefore favoring miners following climate disclosure guidelines such as the GHG Protocol and TCFD.

Pressures of Regulation and Finance Change the Mining Map

The post-halving mining industry is being shaped in great part by the shifting regulatory terrain. Though still under discussion, the Digital Asset Mining Energy (DAME) excise tax plan in the United areas has driven miners to migrate to areas with more friendly crypto laws or go global. Countries like the UAE and Nigeria are building regulatory sandboxes to draw compliant crypto mining operations supported by renewable energy sources concurrently.

Site choice and infrastructure spending are being influenced by regulatory clarity on environmental reporting standards, energy consumption disclosures, and Bitcoin mining taxation. Businesses who proactively match these changing rules gain first-mower benefits including tax rebates, shorter permitting times, and improved brand recognition.

The Future of Profitability in Bitcoin Mining

Future profitability of Bitcoin mining in 2025 and beyond will rely on a multifarious approach. To be competitive, miners have to keep lowering running expenses, finding cheap and clean energy, and routinely upgrading technology. Leading companies are starting to standardize the integration of artificial intelligence for predictive maintenance, real-time profitability algorithms, and load optimization grounded on machine-learning.

Concurrent with this diversification into related services such grid stabilization, data center co-location, and staking services for other Blockchain Revolutionize is miners. Using current infrastructure for multi-chain income sources, this diversification approach helps to offset Bitcoin price volatility.

Furthermore predicted to lower network congestion and indirectly impact transaction fees and miner income are improvements in Bitcoin Layer 2 including Lightning Network and forthcoming Zero-Knowledge Proofs (ZKPs). The way Layer 1 and Layer 2 economics develop together will determine whether these adjustments boost or reduce miner income.