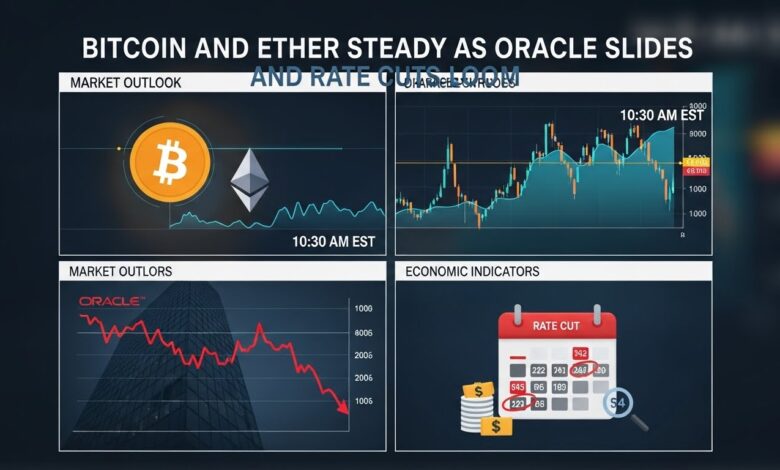

Bitcoin and Ether Steady as Oracle Slides and Rate Cuts Loom

Bitcoin and Ether steady while Oracle tumbles on AI bubble fears and traders brace for the next wave of Fed rate cuts. What it means now.

When markets get spooked, they usually don’t whisper. They slam doors. Yet today’s tape is doing something more interesting: Bitcoin and Ether steady while a shockwave in AI-linked equities sends Oracle into a sharp selloff, and macro traders keep one eye on the Federal Reserve’s next move. That mix—crypto stability, tech turbulence, and rate-cut expectations—creates the kind of cross-asset tug-of-war that can set up the next big trend. Oracle’s tumble has revived “AI bubble” chatter in equities, but in crypto, the reaction has been more measured, suggesting traders may be waiting for a clearer signal from U.S. inflation prints, labor data, and the rate path ahead. This exact setup—Bitcoin and Ether steady as risk markets wobble—often becomes the quiet prelude to a louder move.

What’s happening: Oracle jolts risk sentiment, crypto holds its ground

Oracle’s drop has become the headline driver because it feeds a broader narrative: heavy AI spending, uncertain payback timelines, and the fear that expectations outran reality. That anxiety pushed through the Nasdaq and other tech-heavy exposures, reigniting “AI jitters” across markets.

What’s striking is that Bitcoin and Ether steady didn’t immediately follow the same script as high-beta tech stocks. Instead, the market looked more like it was digesting the news rather than panic-selling it—an important distinction if you’re watching whether crypto is trading like a pure risk asset or increasingly like a liquidity-and-rate-sensitive macro hedge. CoinDesk’s market coverage framed it as traders focusing on preserving structure rather than chasing upside, with attention concentrated in large-cap crypto.

Bitcoin and Ether steady: why this matters more than it sounds

The phrase Bitcoin and Ether steady can feel boring—until you notice what’s happening around it. A stable BTC/ETH backdrop during an equity shock can imply one (or several) of these dynamics:

Crypto traders may have already priced in a “risk-off” pocket earlier, reducing the need for fresh deleveraging.

Macro participants may be treating BTC and ETH as rate-sensitive assets, and rate-cut expectations can cushion downside even when equities wobble.

Liquidity is rotating, not fleeing—meaning capital is picking “where to hide” inside risk rather than running for the exits.

In other words, Bitcoin and Ether steady is not the story. It’s the signal behind the story: how markets are reallocating risk as AI euphoria gets questioned and monetary policy expectations take center stage.

AI fears and Oracle’s slide: why equities reacted so violently

Oracle’s decline didn’t land in a vacuum. The market has been primed for a reality check on AI infrastructure economics—how much debt and capex is being stacked up, and whether demand growth will justify it. Reuters reported Oracle’s forecast and AI spending concerns helped push the Nasdaq lower, with broader worry about AI profitability and “bubble” dynamics.

Other reporting emphasized how quickly value can evaporate when expectations crack. The Guardian described the selloff as wiping tens of billions off Oracle’s market value and amplifying fears that AI-related stocks may be priced for perfection.

This matters for crypto because market stress doesn’t always transmit through the same pipe. Sometimes it hits crypto through leverage and liquidations. Other times it arrives through the dollar, yields, and liquidity conditions. When Bitcoin and Ether steady while AI equities fall hard, it hints the transmission channel may be more selective—at least for now.

Rate cuts are the other headline: why traders are “eyeing the next wave”

Even as AI fears dominated the equity narrative, macro traders kept circling back to monetary policy. If the market believes rate cuts are coming—or continuing—risk assets can regain footing surprisingly fast, because lower rates can increase the present value of future cash flows in equities and ease financial conditions more broadly. Reuters noted expectations around a Fed cut helped temper some anxiety even as AI concerns flared.

This is where Bitcoin and Ether steady becomes especially interesting. Crypto is deeply sensitive to liquidity conditions. If traders think the Fed is shifting toward easing, BTC and ETH can find support even during equity drawdowns—particularly if the drawdown is “story-specific” (AI spending fears) rather than a full macro panic.

Macro backdrop: why yields and the dollar still call the shots

To understand why Bitcoin and Ether steady can persist while tech stocks bleed, you have to track the trio that often dictates crypto’s short-term direction:

U.S. Treasury yields, especially at the front end where policy expectations show up first

The U.S. dollar (DXY) as a proxy for global liquidity tightness

Risk appetite measures like Nasdaq futures that reflect growth sentiment

When yields fall on rate-cut pricing, it can relieve pressure on speculative and duration-like assets—crypto included. When yields rise or the dollar surges, crypto often feels the squeeze. This is why the “next wave of rate cuts” narrative matters as much as the Oracle narrative: it can either mute contagion or amplify it depending on how the bond market reacts.

How AI bubble fears spill into crypto—without a copy-paste crash

Markets love simple correlations, but they rarely last. AI bubble fears can hit crypto in a few distinct ways:

Sentiment contagion: traders de-risk broadly, selling anything volatile

Funding stress: tighter conditions raise the cost of leverage, pressuring derivatives-heavy corners of crypto

Rotation behavior: capital moves from speculative altcoins into BTC/ETH, making Bitcoin and Ether steady even if the broader market is choppy

That last point is key. When uncertainty rises, traders often consolidate into the most liquid crypto assets. That can stabilize BTC and ETH while smaller caps wobble more. CoinDesk’s reporting noted flows concentrated in large-cap assets, consistent with a “quality within risk” rotation.

The derivatives angle: why “steady” often means “coiled”

Spot prices don’t tell the full story. In many crypto cycles, the real pressure builds in: Perpetual funding rates (are traders paying to stay long or short?) Options implied volatility (are traders expecting big swings?) Open interest (is leverage rising even while price stalls?)

A period where Bitcoin and Ether steady can actually be a setup—especially if traders are quietly adding options exposure ahead of a macro catalyst like CPI or a Fed meeting. That doesn’t guarantee a breakout, but it increases the odds that when the market does move, it moves fast.

Bitcoin and Ether steady — what to watch next

If you’re tracking the next catalyst, the market is basically balancing two competing narratives:

AI anxiety says: risk could unwind further if earnings and spending expectations keep deteriorating.

Rate cuts say: easing financial conditions could support risk assets, especially liquid leaders like BTC and ETH.

The next direction often comes down to which narrative wins the next data print. That’s why traders are watching U.S. macro releases and Fed communication so closely, even while the Oracle story dominates headlines.

Watch inflation data and the “Fed reaction function”

If inflation readings cool, the “next wave of rate cuts” theme strengthens, and Bitcoin and Ether steady can turn into a grind higher as liquidity expectations improve. If inflation re-accelerates, markets can quickly reprice cuts away—often a negative shock for risk.

Watch labor data for signs of slowdown or resilience

A weakening labor market can push rate-cut expectations forward, but it can also stoke recession fears. The difference matters. “Cuts because inflation is falling” is often risk-positive; “cuts because growth is breaking” can be risk-negative at first.

Watch tech credit stress and AI capex headlines

One detail that spooked markets in this Oracle move was the stress signal in credit protection pricing and worries about funding large AI buildouts. When credit markets start flashing yellow, equities can re-rate quickly. Reuters highlighted concerns around AI profitability and Oracle’s outlook as part of the risk-off impulse.

Why Bitcoin and Ethereum can diverge from tech—even when headlines rhyme

Yes, BTC and ETH often trade like high-beta tech. But there are moments where they diverge:

Bitcoin can act like a liquidity barometer rather than an “AI stock proxy.”

Ethereum can trade more on ecosystem catalysts, staking dynamics, and on-chain activity than on Nasdaq headlines.

That’s why Bitcoin and Ether steady during a tech shock isn’t impossible—it can be the market saying: “We’ll reprice equities for earnings risk, but we’ll wait on crypto until the macro rates story resolves.”

CoinDesk also covered a related risk move where BTC and Nasdaq futures dipped together amid AI bubble fears tied to Oracle earnings, showing correlation can return quickly when the macro tape shifts.

What this cross-asset moment could mean for 2026

This Oracle-AI-rate-cuts mix is a preview of a theme markets may wrestle with into 2026: massive capex cycles colliding with the cost of capital. If rate cuts reduce funding pressure, markets can tolerate big investment narratives longer. If rate cuts disappoint—or inflation stays sticky—stories built on “spend now, profit later” can unravel.

For crypto, the implication is nuanced. If liquidity improves, crypto often benefits. If risk sentiment collapses because credit stress spreads, crypto can still get dragged lower in the short run—even if the long-run thesis remains intact.

So the real question behind Bitcoin and Ether steady is: are we seeing early “risk rotation,” or are we seeing the calm before broader deleveraging?

Conclusion

Right now, the market is sending a layered message: AI euphoria is being questioned in equities, Oracle’s stumble is feeding broader risk nerves, and yet Bitcoin and Ether steady suggests crypto traders are waiting for macro confirmation—especially on the timing and depth of rate cuts.

If you want to stay ahead of the next swing, follow the data that changes rate expectations, watch whether tech stress spreads into credit, and monitor whether Bitcoin and Ether steady starts attracting stronger spot demand or rising derivatives leverage. For more updates and clean, macro-first crypto breakdowns, keep following this series—because the next time Bitcoin and Ether steady during an equity shock, it may be the market quietly tipping its hand before the next big move.