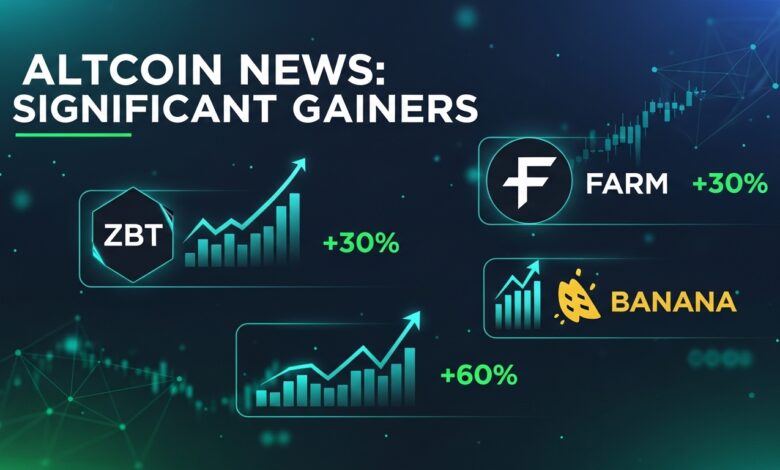

Altcoin News Significant Gainers: ZBT, FARM & BANANA Rally

Discover the latest altcoin news, significant gainer,s including ZBT, FARM, and BANANA. Explore price movements, market analysis, and investment insights.

altcoin news significant gainers spotlight, three tokens have captured the attention of traders and investors worldwide: ZBT, FARM, and BANANA. These cryptocurrencies have registered impressive gains that reflect broader market sentiment and specific project developments. Understanding what drives these significant gainers in altcoin news provides valuable insights for anyone looking to navigate the volatile yet rewarding world of digital assets. The performance of these tokens represents more than just numbers on a chart; they tell stories of technological innovation, community engagement, and evolving market dynamics that shape the future of decentralized finance.

Current Cryptocurrency Market Landscape

The digital asset ecosystem has evolved dramatically over recent years, transforming from a niche technology into a mainstream financial phenomenon. The altcoin news significant gainers we observe today operate within a complex network of blockchain protocols, decentralized applications, and innovative financial instruments. Market participants ranging from retail investors to institutional players continuously analyze price movements, seeking opportunities that align with their investment strategies and risk tolerance levels.

Current market conditions reflect a fascinating interplay between regulatory developments, technological advancements, and macroeconomic factors. The cryptocurrency sector has demonstrated remarkable resilience despite facing numerous challenges, including regulatory scrutiny, market volatility, and periodic bearish cycles. This resilience stems from the fundamental value propositions that blockchain technology offers: transparency, decentralization, security, and the potential to revolutionize traditional financial systems.

The tokens featured in today’s altcoin news for significant gainers represent different segments of the cryptocurrency ecosystem. Each project brings unique value propositions, technological innovations, and community-driven development efforts that contribute to their market performance. Analyzing these gainers requires understanding not just their price movements but also the underlying factors that drive investor interest and market demand.

ZBT Token: Analyzing the Impressive Rally

ZBT has emerged as one of the standout performers in recent altcoin news significant gainers reports. This digital asset has captured market attention through a combination of strategic developments, partnership announcements, and growing adoption within its target ecosystem. The token’s price trajectory reflects increasing confidence among holders and new investors who recognize the project’s potential for long-term growth.

The technology behind ZBT focuses on solving real-world problems through blockchain innovation. The project’s development team has consistently delivered on roadmap milestones, building credibility within the cryptocurrency community. This track record of execution distinguishes ZBT from numerous other projects that struggle to translate ambitious visions into tangible results. The token’s utility within its native ecosystem creates organic demand that supports price appreciation beyond mere speculation.

Trading volume for ZBT has surged alongside price increases, indicating genuine market interest rather than artificial manipulation. This volume expansion suggests that both retail and institutional investors are accumulating positions, anticipating further upside potential. The token’s liquidity profile has improved significantly, making it more accessible for traders across various exchanges and trading platforms.

Market analysts examining altcoin news significant gainers frequently highlight the importance of fundamental analysis. For ZBT, fundamentals include the project’s tokenomics design, utility functions, governance mechanisms, and integration partnerships. These elements combine to create a comprehensive value proposition that extends beyond short-term price speculation. Investors who conduct thorough research often discover that sustainable gains emerge from projects with solid fundamentals rather than purely hype-driven pumps.

The community surrounding ZBT demonstrates strong engagement levels across social media platforms, developer forums, and governance discussions. Active communities often correlate with project longevity and sustained growth. When token holders actively participate in ecosystem development, they create network effects that attract additional users, developers, and investors. This virtuous cycle can propel projects from obscurity to prominence within the competitive cryptocurrency landscape.

FARM Token: Decentralized Finance Innovation Driving Growth

FARM token represents the intersection of blockchain technology and agricultural finance, positioning itself uniquely within the altcoin news significant gainers category. The project leverages decentralized finance protocols to create innovative solutions for yield farming, liquidity provision, and automated market-making strategies. These functionalities have attracted significant attention from DeFi enthusiasts seeking optimized returns on their cryptocurrency holdings.

The DeFi sector continues experiencing rapid innovation, with projects constantly developing new mechanisms for capital efficiency and yield generation. FARM has distinguished itself through user-friendly interfaces, robust security measures, and transparent governance structures. These characteristics address common concerns that prevent mainstream adoption of decentralized financial services. By prioritizing user experience alongside technical sophistication, FARM appeals to both experienced crypto traders and newcomers exploring DeFi opportunities.

Price performance for FARM reflects growing total value locked within its protocols, a key metric that DeFi analysts monitor closely. When users deposit more assets into a protocol, they signal confidence in its security, functionality, and yield-generating capabilities. This metric provides insight into organic growth versus superficial hype. Projects that sustainably increase their total value locked typically demonstrate stronger long-term prospects than those experiencing temporary spikes driven by short-lived marketing campaigns.

The tokenomics model governing FARM incorporates mechanisms designed to align incentives between protocol users, liquidity providers, and governance participants. Well-designed tokenomics create sustainable economic systems where all stakeholders benefit from protocol success. These systems often include staking rewards, governance voting rights, fee distribution mechanisms, and deflationary supply dynamics. Understanding these economic models helps investors evaluate whether current price levels reflect fair valuations or present opportunities for entry or exit.

Security audits conducted by reputable blockchain security firms have bolstered confidence in FARM’s smart contract infrastructure. In the DeFi space, security represents the paramount concern for users entrusting their capital to automated protocols. High-profile exploits and hacks have plagued numerous projects, causing catastrophic losses for users and irreparable damage to project reputations. FARM’s commitment to rigorous security practices positions it favorably among cryptocurrency market trends observers who prioritize safety alongside returns.

BANANA Token: Gaming and Entertainment Sector Momentum

BANANA token has captured attention within altcoin news significant gainers through its innovative approach to blockchain gaming and digital entertainment. The project bridges traditional gaming experiences with blockchain technology, creating new paradigms for player ownership, in-game economies, and content creator monetization. This convergence of gaming and cryptocurrency represents one of the most promising applications for blockchain technology beyond purely financial use cases.

The gaming industry generates hundreds of billions in annual revenue, dwarfing many traditional sectors. Blockchain integration introduces concepts like true digital ownership, play-to-earn mechanics, and decentralized gaming economies that fundamentally alter player-developer relationships. BANANA leverages these innovations to create engaging experiences where players maintain control over their digital assets, earning real value through gameplay achievements and community participation.

Market performance for BANANA correlates with partnership announcements, game launches, and expanding user bases. Unlike purely speculative tokens, gaming tokens derive value from actual usage within their ecosystems. Players need tokens to purchase in-game items, access premium features, or participate in governance decisions affecting game development. This utility-driven demand creates more stable value propositions compared to tokens lacking real-world applications.

The BANANA ecosystem includes multiple gaming titles, each contributing to token utility and demand. This diversification strategy mitigates risks associated with single-product dependencies. When projects expand across multiple applications, they create resilient ecosystems capable of weathering challenges affecting individual components. Investors analyzing digital asset performance often favor projects demonstrating strategic diversification over those relying on single points of failure.

Community engagement metrics for BANANA show impressive numbers across social platforms, streaming channels, and gaming forums. Active gaming communities generate organic marketing through content creation, gameplay streams, and community events. This grassroots promotion proves more effective than traditional marketing expenditures, creating authentic enthusiasm that attracts new players and investors. The gaming sector’s social dynamics amplify successful projects while quickly exposing those lacking genuine engagement.

Technical Analysis: Chart Patterns and Price Movements

Technical analysis provides valuable frameworks for understanding price movements among altcoin news significant gainers. Chart patterns, indicator signals, and volume profiles offer insights into market psychology and potential future directions. While technical analysis cannot predict outcomes with certainty, it helps traders identify probabilistic scenarios and manage risk accordingly.

ZBT’s price chart displays classic bullish patterns including higher lows, breakout formations above resistance levels, and strong volume confirmation. These patterns suggest accumulation phases where smart money positions itself before anticipated rallies. Technical traders use these signals to time entries and exits, optimizing risk-reward ratios. Moving averages show bullish alignment with shorter timeframes crossing above longer ones, traditionally interpreted as positive momentum indicators.

FARM’s technical picture reveals consolidation periods followed by explosive moves, characteristic of tokens with strong fundamental catalysts. These patterns emerge when projects announce significant developments, causing rapid price discovery as markets reassess valuations. Support levels established during consolidation phases provide reference points for risk management. Traders setting stop-loss orders below key support levels protect capital while maintaining exposure to upside potential.

BANANA demonstrates momentum characteristics with sustained uptrends and minimal retracements. This price behavior indicates strong buying pressure overwhelming selling interest. Relative strength indicators show overbought conditions periodically, suggesting potential consolidation phases. However, strong fundamental narratives can sustain overbought technical readings longer than traditional analysis might predict. Combining technical signals with fundamental assessment creates more robust analytical frameworks.

Volume analysis across all three cryptocurrency gainers reveals increasing participation from market participants. Rising volume during price increases confirms trend strength, while declining volume might signal exhaustion. Volume profile analysis identifies price levels with significant trading activity, marking areas likely to act as support or resistance in future trading. These technical tools help traders navigate volatile markets more effectively.

Fundamental Factors Driving Altcoin Performance

Understanding fundamental factors separates informed investors from speculators chasing short-term pumps. The altcoin news significant gainers featured today demonstrate specific fundamental strengths that justify market attention. These factors include technological innovation, real-world utility, partnership ecosystems, regulatory positioning, and community development.

Technological innovation forms the foundation for sustainable cryptocurrency projects. Blockchains offering superior speed, scalability, security, or functionality attract developers building applications and users seeking efficient solutions. Projects that successfully balance these technical attributes position themselves advantageously within competitive markets. Continuous development efforts signal commitment to long-term viability rather than quick cash grabs common among less reputable projects.

Real-world utility determines whether tokens maintain value beyond speculative trading. Cryptocurrencies solving actual problems or enabling new capabilities create organic demand supporting price appreciation. Use cases ranging from decentralized finance to supply chain management, identity verification to content monetization demonstrate blockchain’s versatility. Projects articulating clear value propositions and demonstrating adoption metrics tend to outperform those lacking concrete applications.

Partnership ecosystems amplify project capabilities through collaboration and integration. Strategic partnerships with established companies, other blockchain projects, or institutional players validate technology and expand addressable markets. These relationships often provide resources, expertise, and distribution channels that individual projects struggle to develop independently. Monitoring partnership announcements helps investors identify projects gaining mainstream traction.

Regulatory positioning grows increasingly important as governments worldwide develop cryptocurrency frameworks. Projects proactively engaging with regulators, implementing compliance measures, and adapting to legal requirements demonstrate maturity and longevity focus. While regulatory uncertainty creates short-term volatility, clear frameworks ultimately benefit legitimate projects by eliminating fraudulent competitors and providing operational clarity.

Community development encompasses the human elements driving cryptocurrency success. Engaged communities contribute code, create content, provide support, and evangelize projects to broader audiences. Decentralized governance mechanisms empower communities to influence project directions, fostering ownership mentality among participants. Strong communities often carry projects through challenging market conditions, providing stability when speculative interest wanes.

Risk Management Strategies for Altcoin Investors

Investing in altcoin news significant gainers requires robust risk management strategies protecting capital while maintaining upside exposure. Cryptocurrency markets exhibit extreme volatility, capable of generating substantial gains or losses within short timeframes. Disciplined approaches help investors navigate these conditions without succumbing to emotional decision-making that destroys portfolios.

Position sizing represents the foundation of risk management. Allocating appropriate capital percentages to individual investments prevents single positions from causing catastrophic portfolio damage. Conservative approaches limit individual positions to small percentages of total capital, ensuring diversification across multiple assets. This strategy acknowledges that even thoroughly researched investments can fail, protecting overall portfolio health despite individual losses.

Stop-loss orders provide automated risk controls limiting downside exposure. These orders automatically sell positions when prices decline to predetermined levels, preventing emotional attachment from extending losing positions. While stop-losses cannot guarantee protection during extreme volatility or market gaps, they enforce discipline during normal trading conditions. Trailing stop-losses adjust dynamically as prices rise, locking in gains while maintaining upside participation.

Diversification across different cryptocurrency sectors, market capitalizations, and risk profiles creates balanced portfolios resilient to sector-specific challenges. Holding only large-cap cryptocurrencies limits growth potential, while exclusively holding small-caps maximizes risk. Balanced approaches include established projects providing stability alongside emerging opportunities offering higher growth potential. This strategy smooths portfolio volatility while maintaining exposure to various market opportunities.

Regular profit-taking disciplines ensure investors realize gains rather than watching paper profits evaporate during market reversals. Establishing predetermined targets for partial position exits removes emotion from selling decisions. Some investors exit percentages at specific profit levels, systematically reducing exposure while maintaining positions for additional upside. Others use time-based approaches, regularly rebalancing portfolios regardless of individual position performance.

Continuous education about cryptocurrency markets, blockchain technology, and investment principles improves decision-making quality over time. Markets evolve constantly, requiring investors to update knowledge and adapt strategies. Following reputable news sources, engaging with analytical communities, and studying successful investors’ approaches accelerates learning curves. Knowledge represents the ultimate risk management tool, enabling informed decisions aligned with personal goals and risk tolerance.

Comparing Performance Metrics Across Gainers

Comparative analysis reveals important differences between ZBT, FARM, and BANANA despite their shared status as altcoin news significant gainers. Each token demonstrates unique characteristics regarding price volatility, volume patterns, market capitalization, and holder distribution. Understanding these differences helps investors select opportunities matching their investment criteria and risk preferences.

Market capitalization provides context for evaluating growth potential and downside risk. Lower market cap tokens often offer higher growth potential but carry increased volatility and liquidity challenges. Larger market caps typically indicate more established projects with proven track records but potentially limited explosive upside. Comparing market caps among gainers helps investors balance portfolio risk-reward profiles according to personal preferences.

Volume-to-market-cap ratios indicate liquidity levels and trading activity relative to project size. High ratios suggest active trading interest and easier entry or exit execution. Low ratios might indicate illiquid markets where large orders significantly impact prices. Liquidity considerations particularly matter for larger investors requiring efficient trade execution without excessive slippage.

Holder distribution analysis reveals concentration risks and community strength. Projects with widely distributed token holdings demonstrate broad community support and reduced manipulation risks. Conversely, tokens concentrated among few wallets face risks from large holders dumping positions. Blockchain transparency enables this analysis through publicly available wallet data, providing insights unavailable in traditional markets.

Price volatility metrics quantify risk-return tradeoffs. Higher volatility creates opportunities for substantial gains but exposes investors to severe drawdowns. Risk-adjusted return calculations help compare opportunities accounting for volatility differences. Some investors prioritize absolute returns regardless of volatility, while others prefer stable growth trajectories with lower downside risks.

Historical performance provides context but offers limited predictive value. Past gains don’t guarantee future performance, as market conditions constantly evolve. However, studying historical patterns reveals project trajectories, team execution capabilities, and community resilience during challenging periods. This information supplements forward-looking analysis based on upcoming catalysts and market trends.

Market Sentiment and Social Media Impact

Social media platforms significantly influence cryptocurrency markets, driving awareness, shaping narratives, and catalyzing price movements. The cryptocurrency market trends we observe today emerge partially from social dynamics amplifying information across global communities. Understanding social sentiment provides valuable context for interpreting price movements and identifying emerging opportunities or risks.

Twitter remains the primary platform for cryptocurrency discussion, hosting conversations among developers, investors, traders, and enthusiasts. Trending topics gain visibility, attracting attention to specific projects or market themes. Monitoring Twitter sentiment through specialized tools reveals shifts in community perception before they manifest in price movements. However, social media sentiment proves notoriously volatile, changing rapidly based on news, rumors, or coordinated campaigns.

Reddit communities provide deeper discussions and analytical content compared to Twitter’s brevity-focused format. Subreddits dedicated to specific cryptocurrencies or general market discussion host debates about fundamentals, technical analysis, and investment strategies. Active Reddit communities often correlate with strong project engagement, though echo chambers can develop where dissenting opinions face suppression. Balanced perspectives require consuming content across multiple platforms and sources.

Telegram and Discord channels offer real-time community interaction and project team accessibility. These platforms host announcements, support discussions, and governance conversations. Direct interaction with development teams provides insights into project directions and team competence. However, these channels also attract scammers impersonating team members or promoting fraudulent schemes. Vigilance protects against social engineering attacks targeting cryptocurrency holders.

YouTube content creators produce educational material, market analysis, and project reviews reaching millions of viewers. Influencer endorsements significantly impact smaller projects, sometimes creating unsustainable hype cycles. Critical consumption of influencer content requires considering motivations, potential biases, and factual accuracy. Reputable creators disclose sponsorships and provide balanced analysis rather than pure promotion.

Sentiment analysis tools aggregate social media data, quantifying community emotions and discussion volumes. These metrics help identify projects gaining traction before mainstream recognition. However, artificial manipulation through bot networks or coordinated campaigns can distort sentiment readings. Combining quantitative sentiment data with qualitative assessment of discussion quality provides more reliable insights into genuine community interest.

Future Outlook for ZBT, FARM and BANANA

Projecting future performance for altcoin news significant gainers requires analyzing planned developments, market conditions, competitive landscapes, and macroeconomic factors. While certainty remains impossible in volatile cryptocurrency markets, informed speculation based on available information helps investors make strategic decisions aligned with their goals and risk tolerance.

ZBT’s roadmap includes technological upgrades, partnership expansions, and ecosystem growth initiatives that could drive continued appreciation. Successful execution of planned milestones would validate current valuations and potentially attract additional investment. However, development delays, competitive pressures, or unfavorable market conditions could impede progress. Monitoring execution against stated objectives provides early indicators of project trajectory.

FARM’s future depends heavily on DeFi sector growth and protocol adoption rates. Expanding total value locked, increasing transaction volumes, and growing user bases would signal healthy ecosystem development. Conversely, security incidents, regulatory challenges, or superior competing protocols could negatively impact performance. The DeFi landscape evolves rapidly, requiring projects to innovate continuously maintaining competitive positions.

BANANA’s prospects tie closely to gaming industry blockchain adoption and specific game launch successes. Successful game releases attracting substantial player bases would drive token demand and price appreciation. Failed launches or declining player engagement could undermine tokenomics and investor confidence. Gaming represents a hits-driven business where successes dramatically outperform failures, creating binary outcome scenarios for gaming-focused tokens.

Broader cryptocurrency market conditions profoundly influence individual token performance. Bull markets typically lift most cryptocurrencies regardless of fundamentals, while bear markets punish even quality projects. Macroeconomic factors including interest rates, inflation, regulatory developments, and traditional market performance create contexts either favorable or challenging for cryptocurrency investments. Successful investors consider both project-specific and market-wide factors when making decisions.

Technological disruption could emerge from unexpected sources, rendering current projects obsolete or dramatically altering competitive dynamics. Blockchain technology evolves rapidly with new consensus mechanisms, scaling solutions, and application paradigms regularly emerging. Projects demonstrating adaptability and innovation capacity position themselves better for long-term relevance compared to those rigidly adhering to outdated approaches.

Investment Strategies for Capitalizing on Altcoin Gains

Developing effective strategies for investing in altcoin news significant gainers requires balancing opportunity pursuit with risk mitigation. Different approaches suit various investor profiles, timeframes, and risk tolerances. Understanding available strategies helps investors select methodologies aligned with personal circumstances and goals.

Long-term holding strategies involve purchasing tokens and maintaining positions through market volatility, focusing on fundamental value rather than short-term price fluctuations. This approach suits investors confident in project fundamentals and willing to endure temporary drawdowns. Long-term holders benefit from reduced transaction costs, simplified tax situations, and potential exposure to maximum upside during extended bull runs. However, this strategy requires strong conviction and emotional discipline during bear markets.

Swing trading captures medium-term trends lasting days to weeks, requiring more active management than buy-and-hold approaches. Swing traders combine technical analysis with fundamental catalysts, entering positions during accumulation phases and exiting during distribution. This strategy generates more frequent returns than long-term holding but demands greater time commitment and market monitoring. Successful swing trading requires understanding chart patterns, momentum indicators, and risk management principles.

Day trading involves executing multiple trades within single days, profiting from intraday volatility. This intensive approach demands significant time, advanced technical analysis skills, and emotional discipline. Day traders rarely hold overnight positions, avoiding gap risks but also missing potential overnight gains. High transaction costs and tax implications make day trading challenging for retail investors lacking professional tools and expertise.

Dollar-cost averaging systematically invests fixed amounts at regular intervals regardless of price levels. This strategy reduces timing risk by averaging purchase prices over time, avoiding attempts to predict market bottoms. Dollar-cost averaging particularly suits investors lacking large lump sums for immediate investment or those uncertain about optimal entry timing. This disciplined approach removes emotion from investment decisions while building positions gradually.

Yield farming and staking strategies generate passive income from cryptocurrency holdings beyond price appreciation. These approaches involve locking tokens in protocols or validation networks, earning rewards for providing liquidity or security. Yield farming returns vary significantly based on protocol, market conditions, and competition among farmers. Understanding smart contract risks, impermanent loss, and tax implications proves essential before deploying capital into yield strategies.

Regulatory Landscape and Compliance Considerations

Regulatory developments increasingly influence cryptocurrency markets, affecting project viability, exchange listings, and investor access. Understanding regulatory environments helps investors anticipate challenges and identify compliant projects likely to survive evolving legal frameworks. The blockchain investment opportunities landscape continuously adapts to regulatory changes across different jurisdictions.

Securities regulations determine whether tokens qualify as securities requiring registration and compliance with investor protection rules. Projects designing tokens as utility assets rather than investment securities attempt avoiding these requirements. However, regulatory agencies increasingly scrutinize token designs, challenging projects claiming utility status. Investors should understand regulatory classifications affecting tokens in their portfolios, as enforcement actions can dramatically impact prices.

Anti-money laundering and know-your-customer requirements affect cryptocurrency exchanges and service providers. These regulations mandate user identification, transaction monitoring, and suspicious activity reporting. While compliance increases operational costs and reduces privacy, it legitimizes cryptocurrency markets and attracts institutional participation. Projects prioritizing compliance demonstrate maturity and regulatory awareness beneficial for long-term viability.

Tax obligations vary significantly across jurisdictions but generally treat cryptocurrency transactions as taxable events. Capital gains taxes apply to profitable trades, while some jurisdictions tax cryptocurrency income. Investors must maintain detailed transaction records enabling accurate tax reporting. Tax considerations influence trading strategies, as frequent trading generates higher tax burdens compared to long-term holding in many jurisdictions.

International regulatory fragmentation creates complexity for global cryptocurrency projects and investors. Permissive jurisdictions attract cryptocurrency businesses, while restrictive countries ban or severely limit activities. Projects must navigate multiple regulatory regimes simultaneously, adapting to diverse requirements. Investors accessing global markets should understand regulations affecting their ability to trade specific tokens or use certain platforms.

Future regulatory developments remain uncertain but trend toward increased oversight and standardization. Major economies developing comprehensive frameworks will likely establish templates adopted elsewhere. Progressive regulation balancing innovation protection with investor safeguards supports healthy market development. Investors monitoring regulatory news gain advantages anticipating changes affecting their holdings and strategies.

Conclusion

The cryptocurrency market continues offering compelling opportunities for informed investors willing to conduct thorough research and implement disciplined strategies. Today’s altcoin news significant gainers—ZBT, FARM, and BANANA—demonstrate how diverse projects across different blockchain sectors can generate substantial returns. However, these opportunities come with corresponding risks requiring careful evaluation and management.

Successful cryptocurrency investing combines fundamental analysis, technical expertise, risk management, and emotional discipline. Understanding project technologies, tokenomics, competitive positioning, and development teams provides foundation for investment decisions. Supplementing fundamental research with technical analysis helps optimize entry and exit timing. Implementing risk management through position sizing, diversification, and stop-losses protects capital during inevitable volatility.

The digital asset ecosystem evolves rapidly, presenting continuous learning requirements for serious investors. Staying informed about technological developments, regulatory changes, market trends, and emerging opportunities distinguishes successful investors from those blindly following hype. Engaging with cryptocurrency communities, consuming quality educational content, and maintaining critical thinking skills accelerates investment sophistication development.

Whether you’re an experienced trader or newcomer exploring cryptocurrency portfolio opportunities, the tokens highlighted in today’s altcoin news significant gainers report deserve careful consideration. Conduct independent research, evaluate personal risk tolerance, and never invest more than you can afford to lose. The cryptocurrency market rewards preparation, patience, and disciplined execution while punishing reckless speculation and emotional decision-making.

Stay informed about the latest altcoin news, significant gainers and market developments to position yourself advantageously for future opportunities. The intersection of technology and finance represented by cryptocurrencies, continues reshaping global economic systems, creating wealth-building opportunities for those prepared to navigate this exciting yet challenging landscape. Begin your research today, develop your investment strategy, and participate in the ongoing financial revolution powered by blockchain technology.

See more; Altcoin Season Cautious Market: Canton, Ethena & Ondo Rise