Justin Sun rejects Ethereum selloff claims, calming market fears as ETH price surges, fueling expectations for future gains. Price has been a big issue recently, especially since Justin Sun was accused of selling large amounts. Justin Sun, TRON (TRX) creator and blockchain pioneer, dismisses these claims. Due to this, analysts predict Ethereum will reach $4,000 shortly. This article examines the denial of Ethereum selloff claims, the ETH price’s effects, and what may trigger a bullish run.

Justin Sun Calms Market

Justin Sun, a prominent blockchain and cryptocurrency supporter denies selling much of Ethereum. Several reports said Sun was selling substantial ETH holdings, which might have lowered Ethereum’s price. Sun quickly and firmly rejected these charges. Sun promises solid Ethereum investments with long-term potential. This response calmed market fears and stabilized ETH’s price after speculation. ETH holders and investors applaud Sun’s denial for lowering market uncertainty. Ethereum’s price has recovered, and experts expect more.

ETH Price Surge Ahead

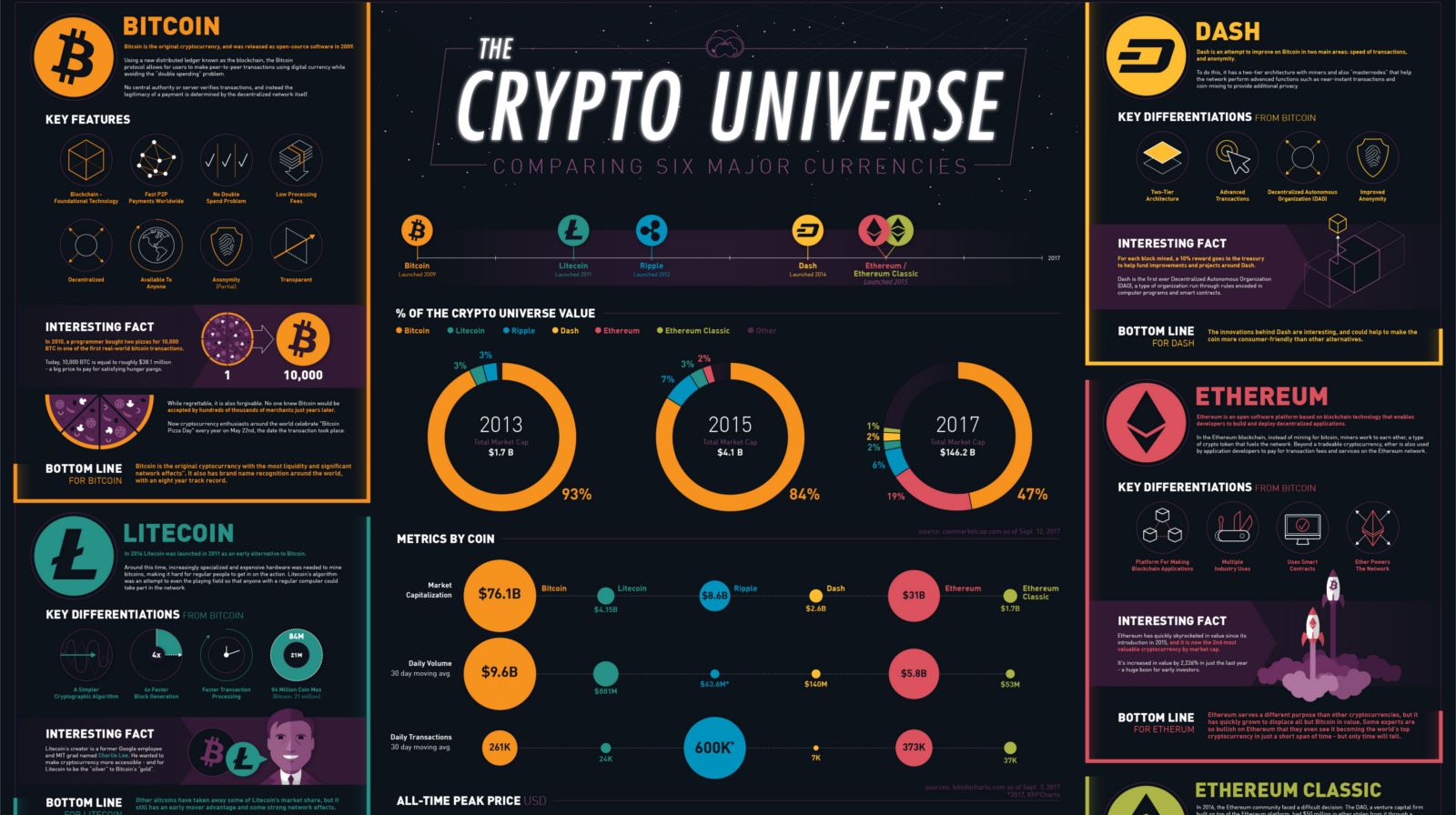

Ethereum, the second-largest cryptocurrency by market capitalization, has long been popular for its smart contracts and decentralized applications. These technological advances have helped Ethereum stay resilient despite price volatility. Ethereum has been rising recently. After Sun denied the Ethereum selloff accusations, ETH’s price has increased, and many analysts expect a $4k gain. Banks and hedge firms desire Ethereum.

Institutional money has sustained Ethereum’s price and liquidity throughout the market turmoil. Ethereum 2.0 “Merge,” or transfer, enhanced energy, scalability, and transactions. These features should draw developers and investors to Ethereum. Ether supports NFT/DeFi. Sectoral popularity would help Ethereum. More DeFi applications protect Ethereum billions. EIP-1559’s Ethereum deflationary mechanism appeared promising. Upgraded tax transactions reduce ETH supply. Supply constraints might push ETH to $4,000, supporting the concept.

Ethereum’s Path to $4K

Sun doesn’t cause Ethereum’s price. ETH is affected by Crypto sentiment. Ethereum is positive despite market turmoil. DApps and commercial smart contracts drive Ethereum’s future. Ethereum, including DeFi, NFTs, and Web3, dominates blockchain and digital economy. Ethereum’s scalability and transaction speed should help. Ethereum can rival Solana and Cardano in smart contracts. Developers and decentralized financial users will boost ETH demand. Ethereum may rise above $4,000 due to deflation and demand.

Investor Sentiment and ETH

Market attitude affects coin pricing. Network upgrades and adoption trends drive long-term success, but investor emotion affects short-term prices—analysts and investors like Ethereum. Although Justin Sun denies selling a lot of ETH, investors may be excited. As Ethereum rises, institutional and retail investors may buy. Many expect $4,000 ETH—possibly more demand. Cryptocurrency opinion changes fast. Ethereum is promising, but investors should consider market and economic aspects.

Also Read: Ethereum Whales Eye $4K with Strategic Buy 22 Dec 20204

Conclusion

Ethereum investors now have clarity and reassurance thanks to Justin Sun’s denial of selloff speculations, which has improved market sentiment. Ethereum, therefore, is in a position to experience a possible price increase that would cause its worth to approach $4,000. It is one of the most promising cryptocurrencies on the market due to the combination of institutional interest.

Ethereum 2.0 updates and the expansion of the DeFi and NFT sectors. Ethereum’s price could continue to climb with adoption and network improvements, and the speculation surrounding a $4,000 rally could become a reality. Investors and analysts will closely monitor ETH as it continues its journey toward new highs.