Bitcoin Long-Time Buyers Cash Out: Silent Exodus Explained

Bitcoin long-time buyers are cashing out as a silent exodus reshapes crypto markets. Discover why veteran holders are selling their positions.

Buyers cash out their positions after years of patient accumulation. This quiet but significant movement represents more than just profit-taking—it signals a fundamental transformation in market dynamics that could reshape the entire digital asset ecosystem. Veteran investors who weathered multiple market cycles, survived dramatic price swings, and maintained unwavering conviction through regulatory uncertainties are now choosing to exit their positions. This phenomenon, often referred to as the silent exodus, is creating ripples across trading platforms and raising critical questions about Bitcoin’s future trajectory. Understanding why these seasoned holders are liquidating their assets becomes essential for anyone invested in or considering entering the cryptocurrency space during this pivotal moment in digital finance history.

Bitcoin Long-Term Holder Exodus

The current wave of selling pressure from established Bitcoin investors cashing out marks a departure from historical patterns observed during previous bull and bear cycles. Long-term holders, typically defined as addresses that have held Bitcoin for more than 155 days without moving their coins, have traditionally served as the bedrock of market stability. These patient investors accumulated during bearish periods when prices languished and mainstream enthusiasm waned, positioning themselves as the ultimate believers in Bitcoin’s fundamental value proposition.

Recent blockchain data reveals that long-term holder supply has begun declining after reaching peak levels in late 2023 and early 2024. This shift represents a significant behavioral change among the cohort that previously demonstrated the strongest conviction. The crypto market exodus isn’t happening through panic selling or emotional decision-making but rather through calculated, strategic liquidations that suggest these veterans have reached their predetermined exit targets or reassessed their risk-reward outlook.

What makes this movement particularly noteworthy is its timing. Unlike previous cycles where long-term holders maintained positions through significant price appreciation, the current exodus is occurring despite Bitcoin trading well above previous all-time highs from 2021. This suggests that price alone isn’t the sole motivating factor—other considerations, including tax implications, portfolio rebalancing needs, generational wealth transfer planning, and changing risk tolerance, are influencing these exit decisions.

Why Veteran Bitcoin Holders Are Selling Now

Several interconnected factors are driving the decision among long-time Bitcoin buyers to cash out after years of accumulation. Understanding these motivations provides crucial insights into both individual investor psychology and broader market mechanics that influence cryptocurrency valuations.

Profit Realization After Extended Holding Periods

Many long-term holders accumulated Bitcoin between 2018 and 2020 when prices ranged from three thousand to twelve thousand dollars. With Bitcoin’s substantial appreciation over subsequent years, these investors are sitting on life-changing gains that represent multiples of their initial investment. The psychological pull to realize these profits becomes increasingly powerful as portfolios swell to sizes that could fund retirements, pay off mortgages, or establish financial security for families.

The veteran Bitcoin holders selling aren’t necessarily losing faith in cryptocurrency’s long-term potential. Instead, they’re applying fundamental investment principles about taking profits and reducing concentration risk. After holding through multiple cycles and experiencing the emotional rollercoaster of extreme volatility, these seasoned investors recognize that unrealized gains only matter once converted to actual purchasing power.

Changing Risk Assessment and Portfolio Diversification

As Bitcoin has matured and gained mainstream acceptance, its risk profile has evolved in the perception of long-term holders. Early adopters who invested small amounts that grew into substantial holdings now face a different risk equation. What once represented a speculative position in a diversified portfolio may now constitute an overwhelming percentage of net worth, creating concentration risk that prudent wealth management demands addressing.

The cryptocurrency investor exodus reflects a natural evolution in risk management strategy. Investors who accumulated Bitcoin when it represented a tiny fraction of their portfolio must reassess as it grows to potentially dominate their asset allocation. Financial advisors consistently recommend maintaining diversified portfolios, and even the most bullish Bitcoin believers acknowledge the wisdom of not keeping all eggs in one basket, particularly as life circumstances change with age, family obligations, or approaching retirement.

Macro Economic Pressures and Liquidity Needs

Global economic conditions have created financial pressures that extend beyond cryptocurrency markets. Rising interest rates throughout 2022 and 2023 made carrying costs for leveraged positions more expensive while simultaneously creating attractive yield opportunities in traditional fixed-income instruments. Some Bitcoin long-term holders exiting positions are responding to these broader economic realities rather than expressing concerns specific to cryptocurrency fundamentals.

Additionally, inflation’s impact on daily living expenses has increased liquidity needs for many households. Investors who previously could afford to hold illiquid or volatile assets may now require access to funds for living expenses, healthcare costs, or unexpected emergencies. The silent exodus includes holders who simply need to monetize assets, not because they’ve lost conviction but because financial realities demand it.

Market Impact of Long-Term Holder Distribution

The movement of Bitcoin from long-time buyers cashing out creates specific market dynamics that differ from typical retail-driven volatility. Understanding these impacts helps contextualize recent price action and anticipate potential future scenarios as this distribution phase continues.

Long-term holder selling typically occurs through over-the-counter desks rather than public exchanges, minimizing immediate price impact. However, the psychological effect on markets can be substantial as on-chain analysts track these movements and share insights across social media and research platforms. When respected holders who survived multiple cycles begin exiting, it creates questions among newer participants about whether they possess information or insights that warrant reconsideration of bullish theses.

The crypto holder liquidation also reduces the supply base of strong hands willing to hold through volatility. Long-term holders traditionally provide price support during corrections by refusing to sell into weakness. As this cohort diminishes, the remaining holder base becomes younger with less experience navigating crypto winters, potentially increasing market fragility and susceptibility to sharper drawdowns during periods of negative sentiment.

However, distribution from old holders to new participants also represents healthy market evolution. Every asset class requires constant turnover and new capital inflows to sustain growth trajectories. The Bitcoin silent exodus creates opportunities for new investors to establish positions at levels the previous generation deems attractive for profit-taking, potentially setting the stage for the next cohort of long-term believers who will hold through upcoming cycles.

On-Chain Data Revealing the Silent Exodus

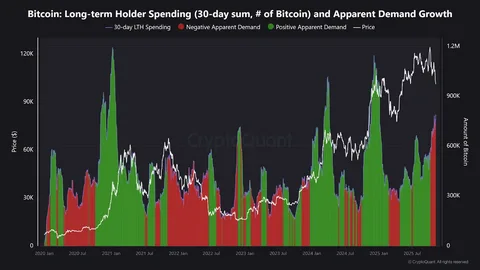

Blockchain transparency provides unprecedented visibility into holder behavior, allowing analysts to track the Bitcoin long-time buyers’ cash-out phenomenon in real-time through on-chain metrics. Several key indicators confirm the exodus narrative and provide quantitative support for what might otherwise remain anecdotal observation.

Long-Term Holder Supply Metrics

The Long-Term Holder Supply metric, which tracks coins unmoved for at least 155 days, peaked in late 2023 before beginning a noticeable decline. This decline accelerated through 2024 as Bitcoin prices appreciated, indicating that rising valuations triggered predetermined exit strategies among patient investors. The data shows that approximately several hundred thousand Bitcoin that had remained dormant for years began moving during this period, representing billions of dollars in realized value.

Realized profit metrics from on-chain analytics firms show substantial increases in coins moving at significant gains, with some addresses realizing profits exceeding one thousand percent on their initial investments. These veteran cryptocurrency holders’ selling created realized profit spikes that historically precede consolidation phases or corrections as markets absorb the selling pressure and establish new equilibrium prices with a refreshed holder base.

Exchange Inflow Age Distribution

Another revealing metric examines the age distribution of coins flowing into exchanges, which serves as a proxy for selling pressure since coins generally move to exchanges for liquidation. Throughout the current cycle, exchange inflows have shown an increasing proportion of old coins—those held for multiple years—compared to younger coins moved by short-term traders. This age distribution confirms that the Bitcoin market exodus involves genuine long-term holders rather than recent buyers experiencing buyer’s remorse after short holding periods.

The dormancy flow metric, which weights coin movements by how long they’ve been inactive, has shown elevated readings indicating that increasingly old coins are being moved. When dormant coins suddenly activate after years of inactivity, it typically signifies major conviction shifts among holders who previously demonstrated ultimate patience and belief in Bitcoin’s long-term value proposition.

Historical Precedents for Bitcoin Holder Exits

The current phase of Bitcoin long-time buyers cashing out isn’t without historical precedent, though each cycle presents unique characteristics based on prevailing market conditions, adoption levels, and broader economic circumstances. Examining previous holder distribution phases provides context for understanding whether current patterns represent normal cyclical behavior or something more concerning.

The 2017 Bull Market Distribution

During Bitcoin’s run to twenty thousand dollars in late 2017, early adopters who accumulated below one thousand dollars began systematic profit-taking. On-chain data from that period shows similar patterns of long-dormant coins moving to exchanges as holders who weathered the 2013-2015 bear market decided to realize gains. That cryptocurrency holder exodus was followed by an extended bear market where prices declined over eighty percent from peak values.

However, drawing direct parallels requires caution since market maturity has evolved substantially. The 2017 market featured primarily retail participation with limited institutional involvement, whereas current markets include corporate treasury allocations, spot exchange-traded funds, and sophisticated financial instruments that didn’t exist during previous cycles. The holder base composition has fundamentally changed, potentially altering how distribution phases unfold.

The 2021 Peak and Subsequent Holder Behavior

The 2021 bull market saw Bitcoin reach approximately sixty-nine thousand dollars, triggering another wave of profit-taking from long-term holders. Unlike 2017, however, many veteran holders maintained larger portions of their positions, believing institutional adoption and maturing infrastructure would support higher sustained valuations. Some holders from that period are now part of the current Bitcoin silent exodus, having held through the 2022 bear market and subsequent recovery before finally deciding to exit.

This delayed selling relative to previous peak prices suggests evolving holder psychology and potentially higher conviction levels among the current generation of long-term believers. Those now choosing to exit after holding through multiple cycles and missing previous opportunities to sell near all-time highs are making calculated decisions based on personal financial situations rather than simply selling into strength because prices reached new highs.

Implications for New Bitcoin Investors

For individuals considering entering the Bitcoin market or existing holders with shorter time horizons, understanding why Bitcoin long-time buyers cash out provides valuable insights for portfolio decision-making and risk assessment. The exodus creates both challenges and opportunities depending on investment timeframes and risk tolerance.

Absorption of Selling Pressure

Markets must absorb the supply being released by exiting long-term holders, which can create price pressure in the short to medium term. New investors should recognize that veteran Bitcoin holders selling represents genuine supply that must find willing buyers at current prices. If demand fails to match this increased selling, prices naturally adjust downward until equilibrium is established at levels where new buyers find value compelling enough to absorb available supply.

However, this distribution also represents opportunity for patient capital. Every seller requires a buyer, and coins moving from strong hands to new holders at current prices creates the next generation of long-term believers who may hold through subsequent cycles. Those willing to buy what veterans are selling could position themselves similarly to how current long-term holders positioned themselves during previous distribution phases.

Risk Assessment in Light of Holder Behavior

The crypto market exodus should prompt honest risk assessment among all market participants. If investors who demonstrated ultimate conviction through multiple cycles and years of patience are now choosing to exit, new participants should carefully evaluate their own conviction levels and investment theses. Are you entering because of fear of missing out, or do you understand Bitcoin’s value proposition well enough to hold through potential drawdowns?

Long-term holders exiting doesn’t necessarily mean Bitcoin’s long-term trajectory is compromised, but it does signal that those with the most experience and the longest time horizons have decided their risk-reward outlook justifies taking profits. New investors should ensure they aren’t buying at the top of a cycle where veterans are distributing to less sophisticated participants, as historically characterized market peaks.

Future Outlook as the Exodus Continues

Projecting how the Bitcoin long-time buyers cash out trend will evolve requires considering multiple scenarios based on different market conditions, adoption trajectories, and macroeconomic developments that influence cryptocurrency valuations and investor behavior.

Potential Supply Absorption Scenarios

If institutional adoption continues accelerating through exchange-traded fund inflows and corporate treasury allocations, this new demand could readily absorb supply from exiting long-term holders without significant price impact. The Bitcoin holder exodus would represent healthy market turnover rather than a concerning weakness signal. New institutional participants often have different motivations, timeframes, and risk tolerances compared to early retail adopters, potentially creating more stable price foundations.

Alternatively, if macroeconomic conditions deteriorate or regulatory pressures intensify, the supply from veteran cryptocurrency investors selling could overwhelm available demand, leading to extended consolidation phases or corrections. In this scenario, the exodus accelerates as remaining long-term holders reassess their positions in light of changing fundamentals, creating self-reinforcing selling pressure that establishes new equilibrium at substantially lower prices.

Evolution of Holder Demographics

The crypto investor liquidation by early adopters naturally creates space for new demographic cohorts to establish positions. Younger investors with different financial situations, risk tolerances, and investment time horizons will form the next generation of long-term holders. These new participants may have stronger hands than previous generations if they’re accumulating with genuine conviction rather than speculative hopes for quick gains.

Understanding that holder turnover is natural and necessary for market health provides perspective on the current exodus. Every mature asset class experiences continuous evolution in its holder base as early adopters realize gains and new participants establish positions. Bitcoin’s transition from a fringe experiment to a recognized asset class naturally involves this demographic shift in ownership.

What the Exodus Means for Bitcoin’s Future

The phenomenon of Bitcoin long-time buyers cashing out represents a critical inflection point that will influence cryptocurrency markets for years to come. Rather than interpreting this exodus through exclusively bullish or bearish lenses, objective analysis recognizes the nuanced implications for Bitcoin’s evolution as both an asset and a technology.

Long-term holder distribution demonstrates that Bitcoin has successfully created life-changing wealth for early adopters willing to maintain conviction through extreme volatility and uncertainty. This wealth creation attracts new participants, validating Bitcoin’s value proposition even as original believers exit positions. The Bitcoin silent exodus confirms that the asset has matured sufficiently that significant portions can be liquidated without completely collapsing prices, indicating genuine market depth and resilience.

However, the exodus also highlights Bitcoin’s ongoing struggle with narratives and use cases. If Bitcoin primarily serves as a speculative investment rather than a functional currency or inflation hedge, then holder turnover simply represents natural profit-taking cycles without deeper implications. If Bitcoin aspires to become a global reserve asset or parallel financial system, then the willingness of long-term believers to exit raises questions about conviction in these grander visions versus simple investment return optimization.

The coming months and years will reveal whether new holders demonstrate the same patience and conviction as those now exiting, or whether the crypto holder liquidation represents a fundamental shift in market composition toward shorter-term, less committed participants. This evolution in holder psychology and demographics will significantly impact Bitcoin’s volatility profile, price stability, and ultimate role in the global financial system.

Conclusion

The current wave of Bitcoin long-time buyers cashing out represents a natural evolution in cryptocurrency markets as early adopters realize extraordinary gains after years of patient accumulation. This silent exodus creates both challenges and opportunities for market participants, requiring honest assessment of personal investment theses, risk tolerance, and financial objectives. Understanding why veteran holders are selling—from profit realization and portfolio diversification to changing life circumstances and macro pressures—provides essential context for navigating this transitional period.

For investors considering positions in Bitcoin or other cryptocurrencies, the Bitcoin long-time buyers cash out phenomenon underscores the importance of developing independent conviction based on thorough research rather than following crowd psychology or fear of missing out. The same factors that convince experienced holders to exit may not apply to your personal situation, time horizon, or investment goals.

Are you ready to make informed decisions about Bitcoin investments as the market evolves? Stay updated on holder behavior trends, on-chain metrics, and market dynamics by following reputable cryptocurrency analysts and conducting thorough due diligence before establishing or maintaining positions. The silent exodus of long-term holders marks a pivotal moment in Bitcoin’s history—ensure you understand its implications before making your next move in the crypto market.

See more;Bitcoin Logs Longest Losing Streak Since 2024 as Fed Repricing Fuels Cautious Rebound